On Wednesday April 2nd, President Trump announced a broad expansion of tariffs to apply to 185 countries and territories. Prior to this, new tariffs were announced to apply to China, Canada and Mexico, as well as sector-specific tariffs on aluminum, steel and automobiles. In this explainer, we’ll cover what has changed in U.S. trade policy and tariffs during 2025, how and when those changes are being applied, what’s covered, and what it means for businesses.

What are the goals of the changes in trade policy?

Tariffs on Mexico and Canada were introduced with the aim of pressuring the United States’ neighbors to do more to tackle alleged fentanyl smuggling and illegal immigration, as well as to protect domestic industry. The stated aim of the reciprocal tariffs according to The Office of the United States Trade Representative is “to balance bilateral trade deficits between the U.S. and each of our trading partners.”

What it means for businesses

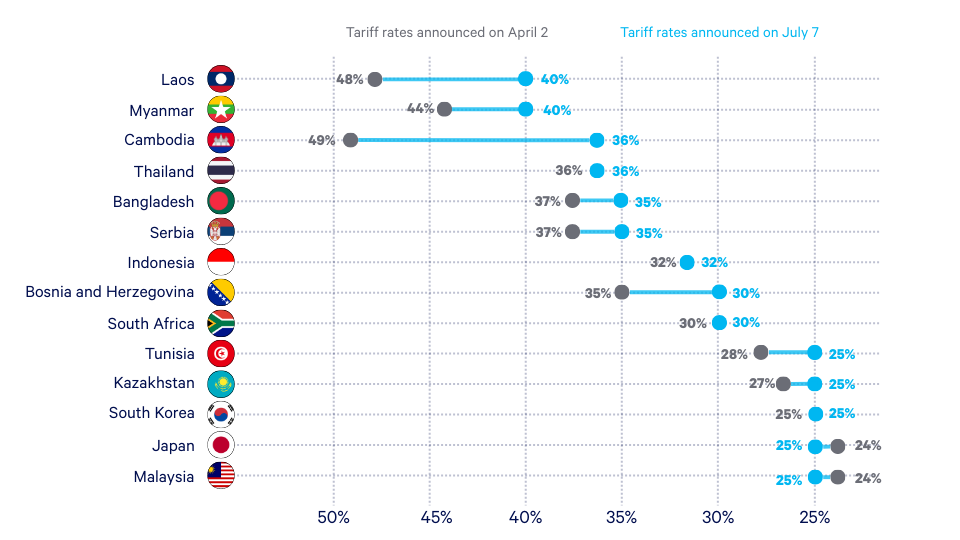

The tariffs have been extensively re-negotiated, 'reciprocal' rates have changed, and deadlines have been extended to allow continued discussions. That uncertainty has left supply chains in a quandary: how to adapt to the unknown? And this unknown is not a far-off future change that cannot be forecasted, but a relatively short term and very impactful unknown that leaves supply chain leaders asking: how much will it cost to make, move and sell our products in a few months, or a few weeks from now? Which nations and suppliers are is best placed to serve our needs in a new world of tariff-affected trade?

The common fears for supply chains are of increased cost of goods sold (COGS), reduced margins, already-committed orders and inventory becoming unprofitable, and the concern that price increases will drive consumer behavior change and reduced demand.

Manufacturers and suppliers are likely to push increased costs on to end-users, and retail brands are likely to also increase prices to protect margins.

How can you react?

Disruption at this scale and speed is challenging in the best of circumstances, but many supply chain organizations are still struggling with slow decision-making, manual scenario planning and limited insight into their trading partners.

The implications of the changing trade policies are potentially enormous and require supply chain leaders to be able to collaborate effectively across functions and with partners—something that’s not possible to do when data is siloed, slow to update and slow to communicate.

To create a playbook for handling this type of uncertainty and disruption at speed and scale requires supply chain managers to be able to see in real time what's happening in their network. They need to be able to see what's happening not just in their own business, but in their trading partners.

Connecting these businesses in a digital supply chain network like the Blue Yonder Network does more than enabling better scenario planning and more agile responses to major shifts like tariff impositions. It also helps supply chains react rapidly to any kind of disruption, helping leaders see issues as they develop rather than once their downstream effects are felt, and allowing them to make the kinds of on-the-fly adaptations and changes that true scenario planning calls for.